Have you ever had your debit card or credit card information stolen from an ATM? If you have, you may have fallen victim to a skimmer. Tiny devices used by fraudsters called “skimmers” can be attached to ATMs and used to steal data off of your debit or credit card magnetic strip.

There’s also an even smaller device called a “shimmer” that can be installed by fraudsters into an ATM machine that steals data from your credit or debit card chip if you have a newer chip-based card. If you’re worried about falling victim to skimmers and shimmers, your first line of defense is to understand what these things are and how to keep yourself safe.

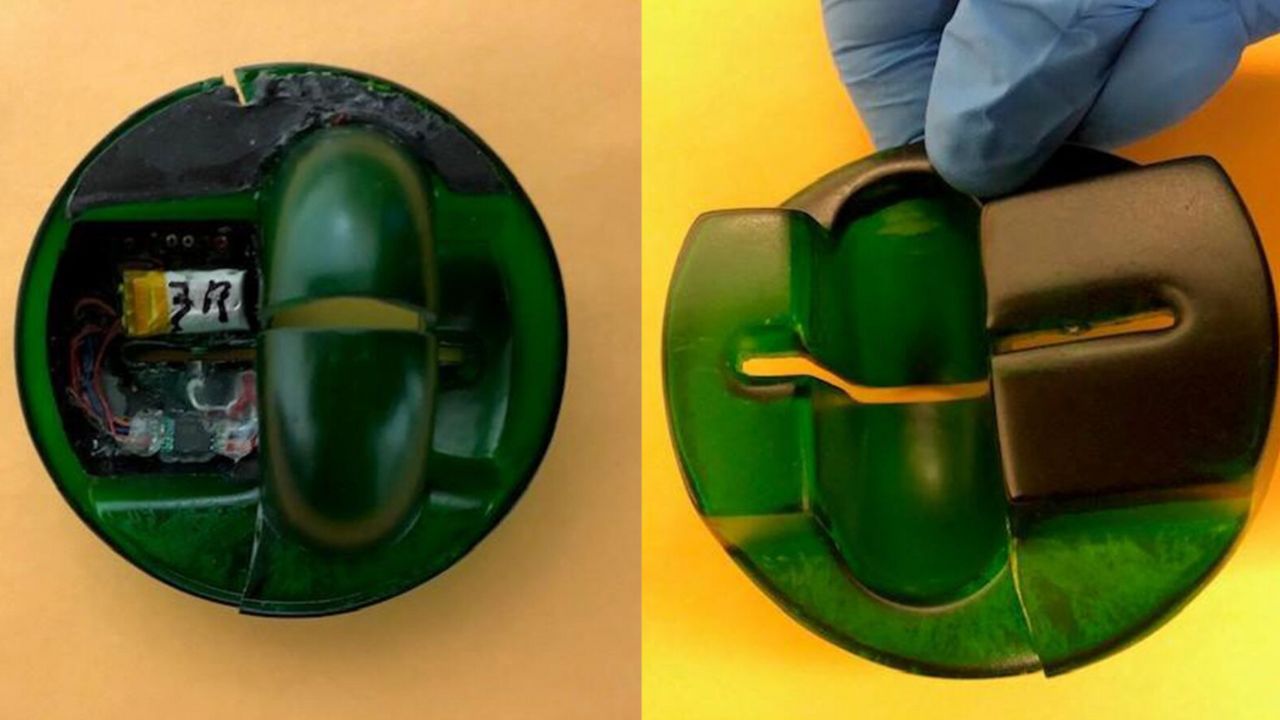

Credit: Dubuque Police Department

How does a ‘skimmer’ work?

Skimmers are fake card readers that can be installed on top of legitimate card readers and steal data from every person who uses the card reader. These can be found on ATMs, gas pumps, and nearly any other card reader device out in the public. Breaking into an ATM is no easy feat, so thieves typically put skimmers on top of the already-existing card reader.

Even more disturbing, though, is that these thieves will also place a hidden camera somewhere near the keypad of the card reader so that they can capture PIN numbers. Some criminals even place false number pads to capture PIN codes, eliminating the need for a hidden camera.

MORE: TIPS TO FOLLOW FROM ONE INCREDIBLY COSTLY CONVERSATION WITH CYBERCROOKS

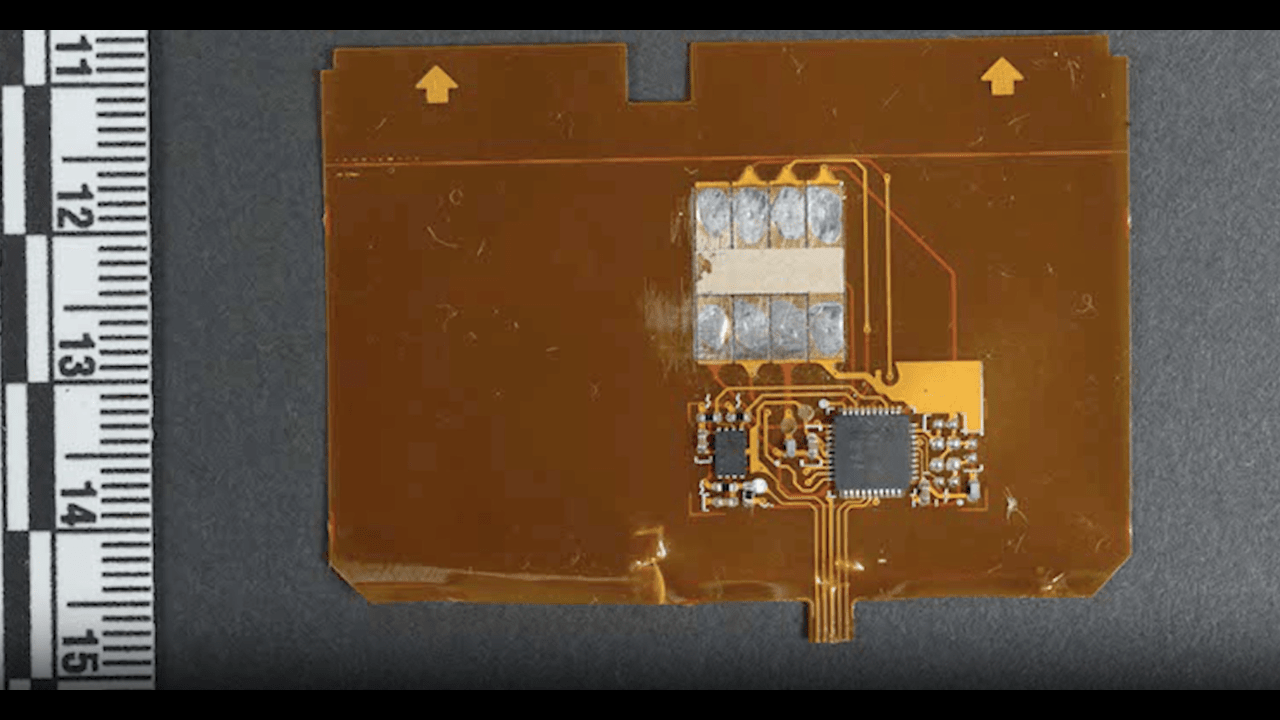

Credit: FBI

How to spot a skimmer

Luckily, there are a few tell-tale signs to see if an ATM you are using has been corrupted by thieves with a skimmer. The first step to spotting a skimmer is to pay close attention to the color of the card slot. Typically, on most ATMs, the card slot and ATM will be the same color. If you notice that there’s a bulky, different-colored card reader, there’s a pretty good chance it’s a skimmer. Skimmers are also installed over the original card reader, so you might notice some dried glue or adhesive around the card reader. Never use a card reader, whether at a gas pump or an ATM, if you suspect a skimmer device has been installed over the original card reader.

MORE: HOW TO FIGHT BACK AGAINST DEBIT CARD HACKERS WHO ARE AFTER YOUR MONEY

Beyond skimmers, beware of the rise in shimming

Skimming is less prevalent than it used to be, but you still should always inspect the card reader and keypad of an ATM before using it, in case a crook has installed a skimmer on it. This is especially pertinent if you are traveling abroad, where skimmers are frequently used by thieves in major tourist areas. However, as skimmers have declined, a new way to steal card data has become popular, called “shimming”

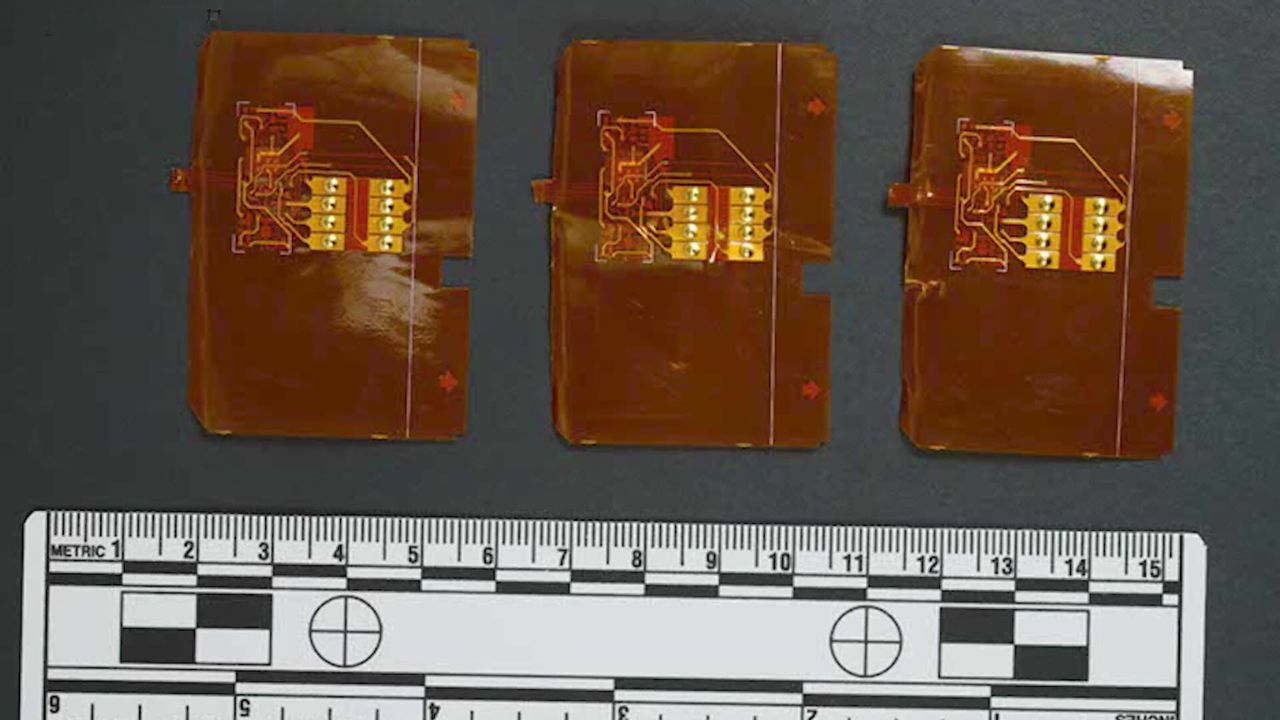

Credit: Royal Canadian Mounted Police

MORE: GOT A CREDIT CARD FRAUD ALERT? HOW CROOKS SWIPE YOUR PAYMENT CARD DETAILS

What are Shimmers?

Skimmers typically don’t work on chip-based credit and debit cards, called EMV cards, which offer a more robust set of security features, such as double encryption between the chip and the magnetic stripe on the back of your card. As you might expect, however, thieves adapt quickly and have developed a system called “shimmers,” which can be used to steal the data from your chip-protected card.

Shimmers are paper-thin devices with a microchip installed on them that are inserted by thieves into ATMs. You can’t see a shimmer from the outside like you can a skimmer, and once you insert your card into the affected ATM, the shimmer steals your card data off the chip, the same way a skimmer would steal your data from the magnetic stripe.

Credit: Royal Canadian Mounted Police

How to keep yourself safe from shimmers

Shimmers, as we just discussed, are impossible to see from the outside of an ATM or other pay terminal, but there are still a few easy ways you can keep yourself from crooks using shimmers.

Tip #1 – Avoid non-bank ATMs

Be cautious of non-bank ATMs. ATMs that are found in bars, convenience stores, and other public places fall victim to card skimmers and shimmers more frequently due to their lack of security features when compared with bank ATMs. Bank ATMs are always the safest to use.

Tip #2 – Utilize contactless payments

An easy way to keep yourself safe when using pay terminals is to use contactless payment systems, such as Apple Pay, Google Pay, Venmo, and Paypal, with your phone instead of inserting your card.

Credit: Apple

MORE: BEST IDENTITY THEFT PROTECTION SERVICES 2024

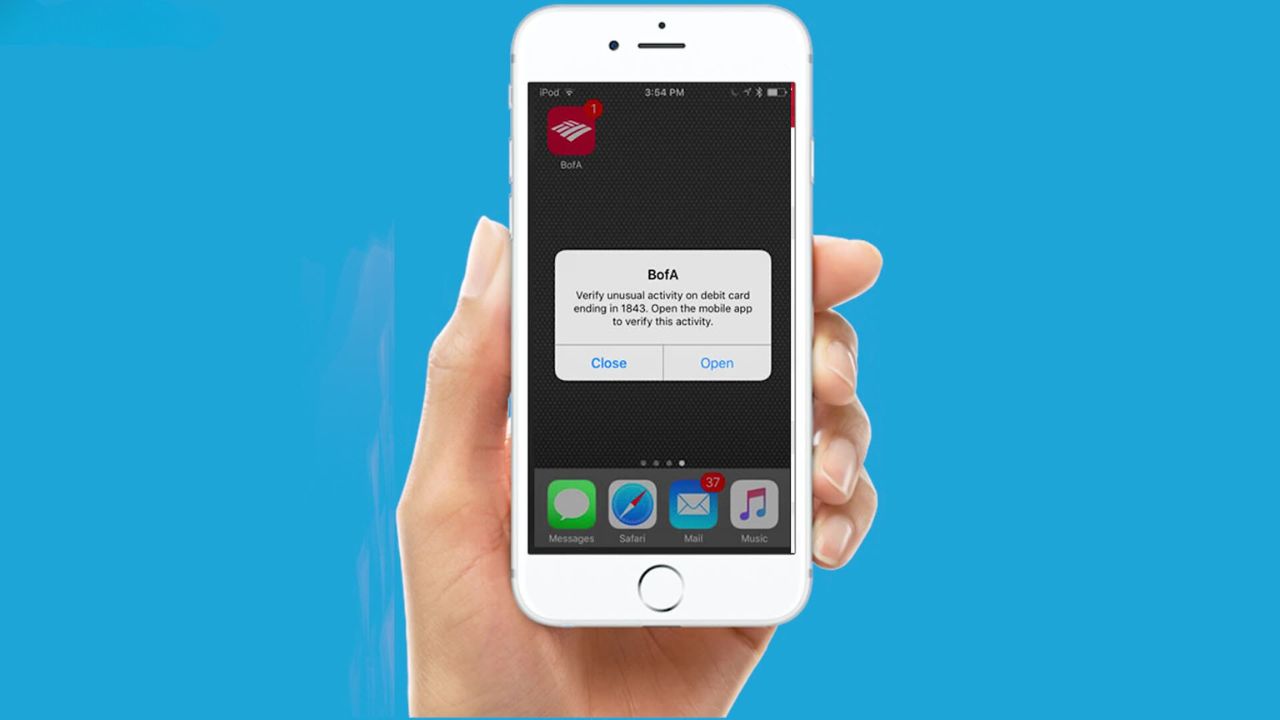

Tip #3 Activate bank alerts on your cards

You can activate mobile alerts on your cards through your bank’s mobile app, which will alert you to any charges being made. This can help keep you safe by quickly identifying any fraudulent charges that need to be canceled.

Credit: Bank of America

MORE: HOW TO EASILY ADD YOUR CREDIT CARDS AND LOYALTY PASSES TO YOUR IPHONE

Kurt’s key takeaways

Even if you do everything right and go over every inch of an ATM, you, unfortunately, can still fall victim to a shimmer. Always remember, if you suspect you’ve been a victim or credit or debit card shimming and skimming, report any fraudulent transactions to your bank immediately. You won’t be held liable, and your money will be returned to your account. Try to avoid using non-bank public ATMs as much as possible, and when possible, opt to use a contactless payment method instead of inserting your card reader into a terminal.

What additional security measures do you think could be implemented to protect consumers from skimmers and shimmers? Let us know in the comments below.

TO GET MORE OF MY SECURITY ALERTS, SUBSCRIBE TO MY FREE CYBERGUY REPORT NEWSLETTER

Related:

- This is how to protect your credit and bank cards from getting hacked

- Why you should never carry these things in your wallet