It’s worth a quick read here and whipping out your wallet to see if you are prime bait for the latest in digital hackers using everyday card readers to skim your credit card number details and go shopping with your money. Originally design for easier contactless payments where you could just wave your credit card at a payment terminal from somewhere like Revel Systems during checkout, now they are posing risks of getting played by a digital crook.

Now Android phones equipped with an NFC chip allowing for a smartphone to read information without touching another device are making this a more prevalent concern.

Now Android phones equipped with an NFC chip allowing for a smartphone to read information without touching another device are making this a more prevalent concern.

NFC stands for Near Field Communication meaning a device with this chip can read and emulate other items such as a credit cards and door access cards using popular RFID also known as Radio Frequency Identification technology.

It takes less than a second for someone running an easily downloaded card reading app to skim everything they need from your credit card to rob you blind and without you ever being touched. Hold the app powered phone within 6 inches of your wallet while standing in line is all it takes.

How to beat a digital pickpocket

1. Shield your credit cards

Regardless of whether you do or don’t have an NFC-chip enabled credit card, the popularity of making a fashion statement with a sensible shielding solution is here with various wallets, card sleeves and now stylish hand bags and clutches designed for our times. The San Diego-based kickstarter success story we fell in love with called Articulate came up with a versatile solution. Articulate’s designs are shaking up the fashion world with their cleverly stylish clutches and wallets that fit every part of your life while offering protection against RFID signals being skimmed from your credit cards and possessions.

Alternatively, wrapping your credit cards as you would last night’s leftovers with aluminum foil can be effective though not necessarily attractive.

2. Replace cards with Non-RFID

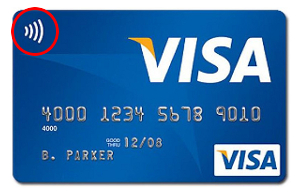

Check to see if any of your credit cards have a symbol or RFID chip embedded on them. If you see any of these symbols and you do not want “contactless” payments or your card to be vulnerable to being read, then reach your card issuer and ask for a replacement without NFC / RFID technology.

Wave symbol on front or back indicates RFID.

What to do if your credit card gets hacked

If you fall victim to this growing trend in pick-pocket hackers, you have some recourse. First, your bank if in the U.S. is obligated to return any fraudulent charges from your card. Debit cards have similar but weaker protections. Notify your bank of unauthorized purchases the moment you see them.

While banks realize the risk of RFID credit cards, a majority claim loss is low or at least that was their message. Chase is discontinuing its “Blink” contactless payment system but won’t say it’s because of this vulnerability.

And good news for now if you think an Apple phone can read your credit cards, Apple has currently restricted using its NFC chips for anything other than Apple Pay. Apps attempting to access the onboard NFC technology are not able to get access.

Either way, be on the lookout for typical card renewals and replacements, many people are finding that credit cards replacements are showing up with RFID chips even when the customer has never requested it.

1 comment

Kurt,

Thanks for the information about the credit cards and the chips that are in them….I am lucky I don’t have any cards like those but when I do get new credit cards or replacement card in the future I will keep an eye out for that chip/symbol…..